Facebook has a tremendous Network Effect economic moat. with enviable billions of users on their family of very popular apps like Facebook, Instagram, Messenger and Whatsapp. I have profited from investing in this gem but has since exited all positions given the recent tech sector share price run-ups. With the recent days’ rout of the tech companies led by Apple (which happens to be very over-valued IMO), I got interested again to see how I can position my entry again.

Facebook is a high-growth company and with so many users on their platforms, there is tremendous future potential if they just increase the average revenue per user they can get (reminds me of my hypothesis about Apple growing their Services revenue as they have billion plus iOS devices). They are definitely trying to expand service offerings such as Room, Watch, Marketplace etc kind of becoming a super-app but there are also alternatives, so it depends on users’ reception to new features they launch.

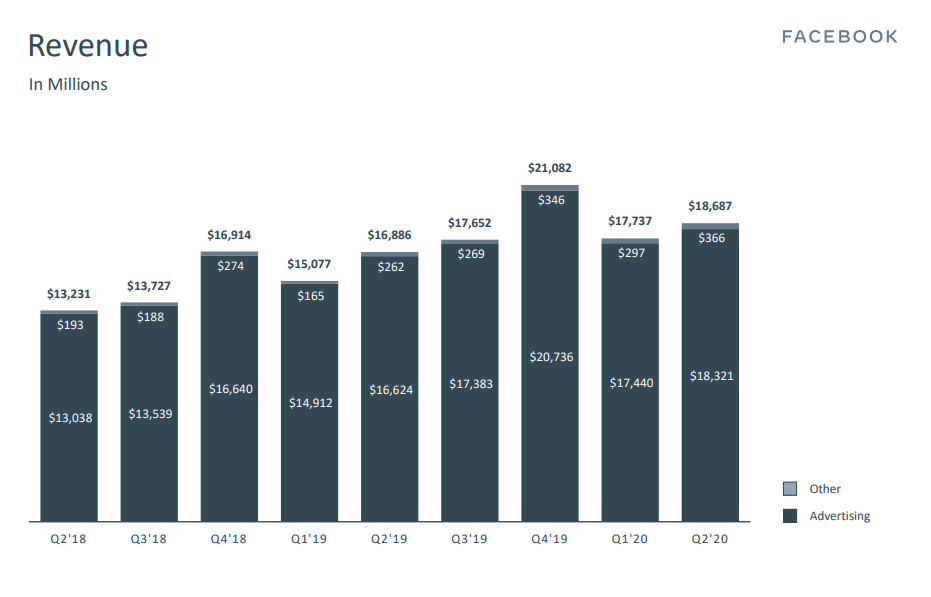

I read their Q2 earnings reports and immediately zoomed into the following chart.

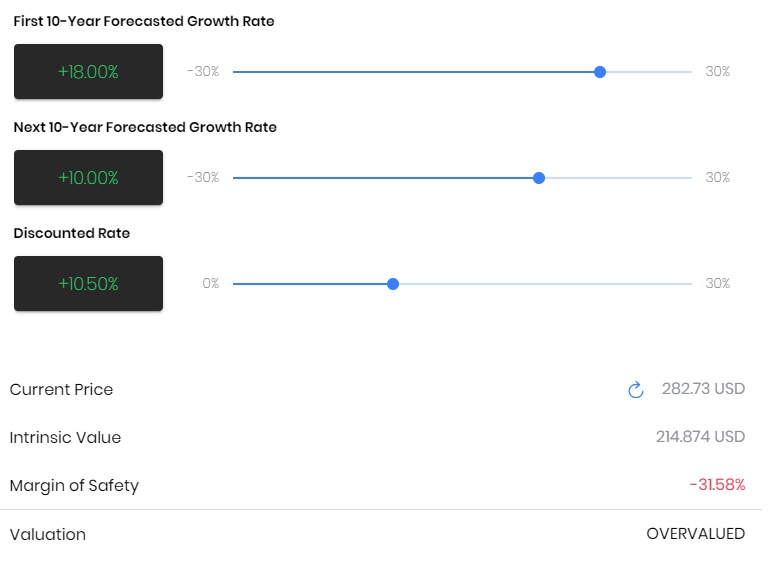

Q2 2020 YoY growth is 10.7%, this rings alarms bells as my previous key assumption is a growth rate of at least 15% to 20%. Perhaps this is also arising from the current pandemic situation where some advertisers cut down advertising budget? I don’t know but I will re-do the valuation of Facebook:

I think given the current share price, there is really no margin of safety however optimistic you want to be regarding this stock.

I remain very positive about the outlook of Facebook but the company tends to attract controversies which usually result in the share price falling quite a bit, so there are perhaps better times to catch a bargain. I personally will be keen to see if the growth rate picks up soon or their indication that the slowing down is a result of the pandemic and they will recover soon.