Is Collecting Rental Income A Good Investment Vehicle?

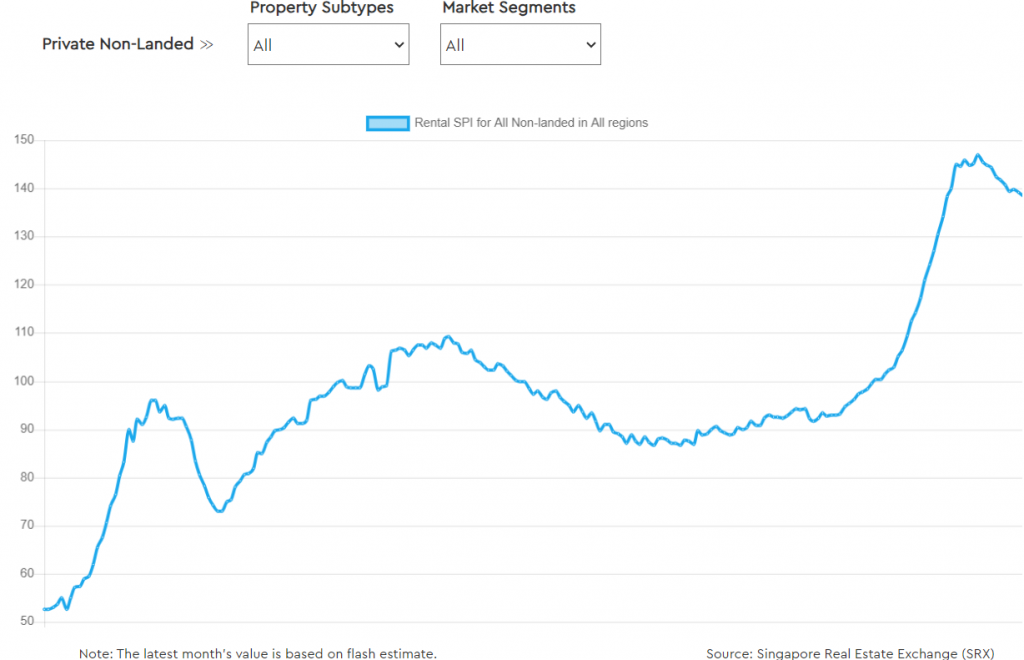

For the last few years, landlords or property owners who rent out their properties to collect rental income have enjoyed a good time. Rental has surged during the pandemic years when supply could not meet demand. We can clearly see this from the private property rental index below (Source SRX: 2006 to April 2024).

Renal Index

In fact, clear trend indicates that the index started the decline since August 2023 and it is still trending down. We would have to wait and see if this is going to be stabilized soon. Even HDB rents fell for the first time since January this year.

One must read this in the correct perspective however. Rental prices spiked towards end of 2020 and the rental index went from slightly higher than 90 to nearly 150, a whopping increase of more than 60%. As such, even at current lowered rental rates, the rental is much better than before.

What is the rental yield that you can get now though?

Rental Compared To Other Investment Types

Depending on location (CCR, RCR or OCR and proximity to MRT/Bus Station) as well as supply and demand of your property, I would say current average rental is probably around 3% after expenses such as 1-month rental equivalent going to property tax and half-month commission to agent. This is not taking into account periods of vacancy when you are still looking for a tenant. At this present moment, it is fair to say that it is still not too difficult to secure a tenant as long as the rental rate expectation is within market norms.

However, are you happy with a 3% rental yield? There are also properties which may yield even less than 3%.

Are there better investments out there that will yield more than 3%? Definitely, like stock investment or putting your money in almost risk-free 6-month T-bill which gives around 3.65%. Some bank fixed deposits currently give more than 3% interest rate as well. Stock investment may provide tremendous capital gains but you must possess some knowledge and skills otherwise downside risks can be high. Interest rates on T-bill and fixed deposit accounts may not remain at current levels too.

Good Rental Yield Is Not Good Enough

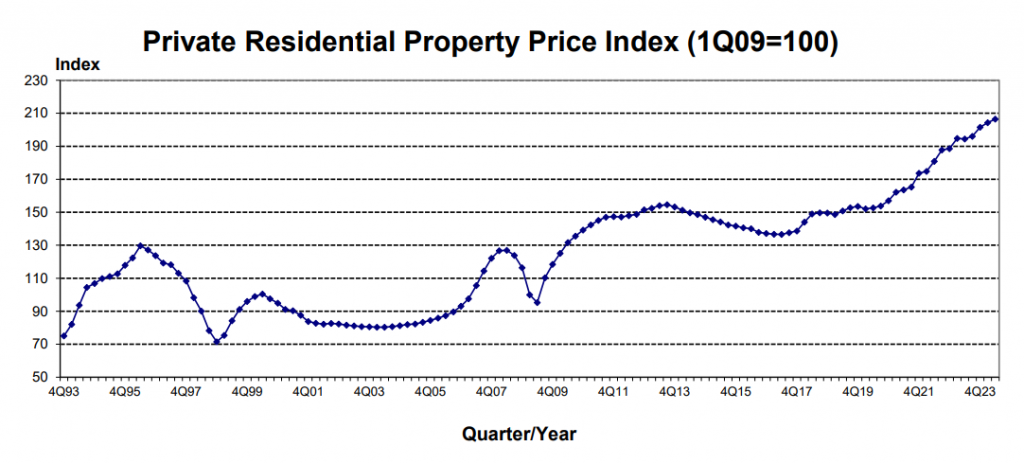

To me, a minimum and consistent rental yield of 2 to 3% per annum is not bad to pay towards maintenance fees of a property and partially paying down the monthly instalment if any but what is more important is the potential capital appreciation of the property over time. Let’s take a look at the Singapore long term private Property Price Index.

Source: URA

The longer-term is definitely a up-trend. There were many property cooling measures introduced from the year 2013 till recently and you may observe that the downward price corrections since 2013 were more subtle. Generally, this can be explained by the fact that most property owners now have only one or two properties, and they not speculators as we know them before, buying and selling properties like “traders” with huge financial leverage. Speculators may need to fire-sell their properties during bad times to free up cash, leading to more drastic price movements.

Without the speculators in the market, the property market is more rational. Property value appreciates over time because of inflationary pressures. Land cost, material cost and labour cost go up over time and therefore property value should go up over time as well. This is especially so if Singapore’s economy continues to do well year over year.

Property prices may not appreciate by what we have seen, 30% over the Covid years because of construction delays, shortage of labour and materials leading to demand exceeding supply significantly. Nevertheless, I presume a baseline appreciation of 3 to 5% per year is very achievable.

I am therefore positive about the long-term prospect of property investment in Singapore as a relatively safe and sound investment vehicle. Rental yield of 2 to 3% plus potential capital appreciation of 3 to 5% per annum is actually fairly attractive for an investment class that is relatively safe. I am also quite conservative here in terms of rental yield and potential capital appreciation.

Property Investment With A Long-term Mindset

Having said so, because of Additional Buyer Stamp Duty (ABSD) for second property onwards and you have one name to buy the first property, you want to ensure you spend enough time doing your homework when purchasing a property to increase your chance of getting the best value out of it. Some factors to consider are:

- Location (somewhere you are familiar and comfortable with, great amenities like shopping malls and eateries nearby, excellent connectivity to other parts of Singapore in terms of express way, public transportation like MRT and buses)

- School factor, if there is any good school within 1km

- Entry price, which means you do want to pay the right price even for a great property

- Exit strategy, who are the likely buyers when you want to exit

- Future transformations, are there developments which are planned for the area which may enhance the value of the property

- Developer track record, if the developer has a good market reputation

- Property project size in terms of number of units and the facilities provided

I hope you find this article useful to you.

Author: Jason Tan Liong Hai (R067670A) | PropNex