Here I refer to the core portfolio as the portfolio of stocks which you have carefully done your homework through PhD Fundamental Analysis and you would be holding for quite some time to reap the benefits of capital appreciation. Below is a sample portfolio. How many stocks should you hold? What is a good number?

Well, this is not an exact Science but if there are too many stocks, you might as well consider investing in an Exchange Traded Fund (ETF). Also, if there are too many stocks, it may be too taxing on you as an individual investor as the amount of research work required may be too daunting.

To me, a good number is probably between 10 to 15. This number provides a good diversification strategy across companies and industry sectors and it is manageable for a retail investor. If you are just starting out, there is no need to rush through the process of building up your portfolio. I believe it is more important to thoroughly discover and research wonderful companies and the efforts you put in will be translated into great profits later.

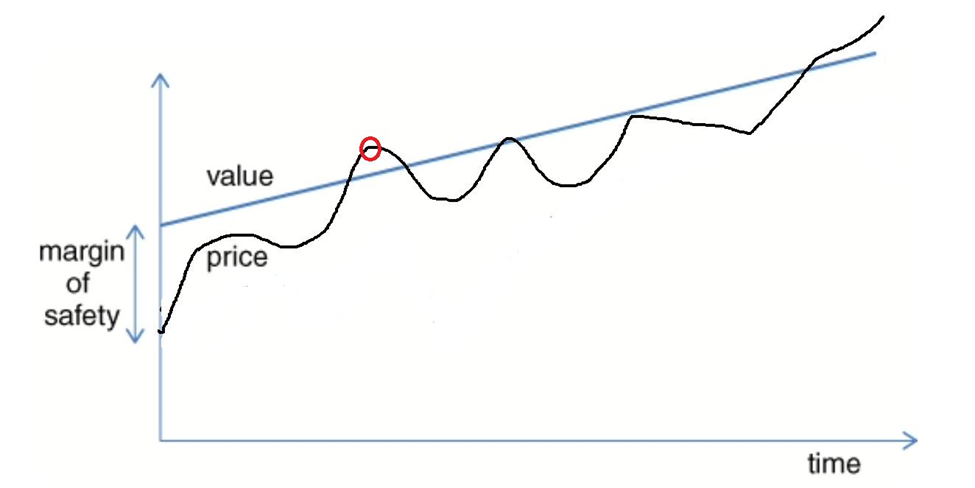

The other thing that I recommend is to slowly buy up the number of shares for each stock in your portfolio according to the dollar budget that you have planned and set aside, unless of course there is a rare situation the said stock is in huge discount to its intrinsic value for whatever reason. Stock prices move up and down in the shorter term for no particular reasons, according to the whims and fancies of Mr Market, therefore it may also pay to adopt Dollar Cost Averaging.

I like to keep abreast of the developments around a stock that I own in my core portfolio. You should catch up with companies’ quarterly or half-yearly earnings updates to ensure that the business fundamentals remain intact and to see if assumptions made in the intrinsic value calculation made during the Valuation step are still valid. Sometimes, you may need to take some “buy more” or sell decisions if conditions have changed, positively or negatively.

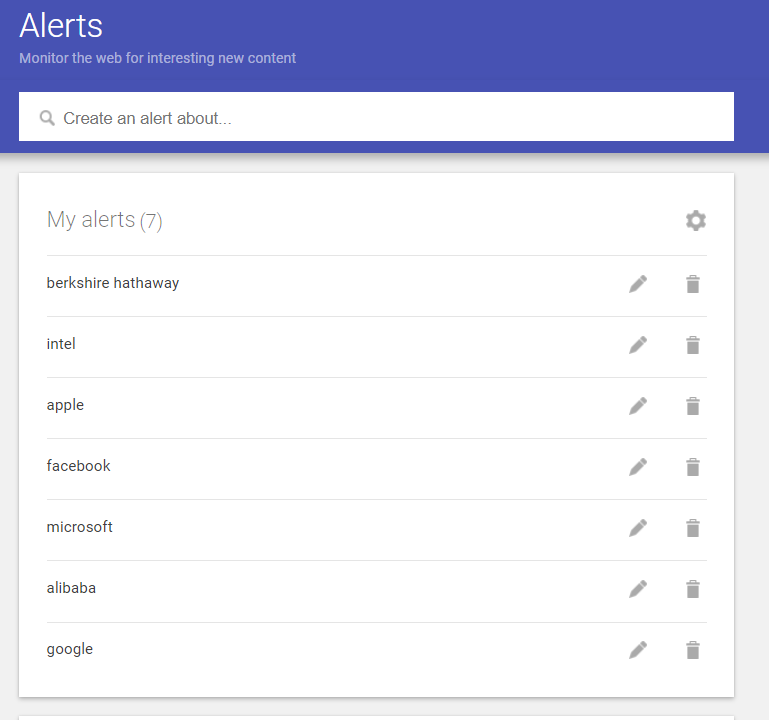

To help me understand more about my portfolio stocks along the way, I leverage on Google Alerts which you can set up through any Gmail account.