Cathie Wood is known for her Tesla pick as well as many other high-growth tech stocks. Her signature exchange-traded-fund (ETF) is ARKK or the ARK Innovation ETF which unfortunately has not been doing well for the past year or so, just looking at the price chart below. The fund has fallen by 50% off the peak which happened just at the beginning of 2021.

So is it wise to still invest with the many ETFs Cathie Wood manages? And specifically, is ARKK going to be a falling knife from this point?

Let’s take a look at ARKK and the top 10 component stocks.

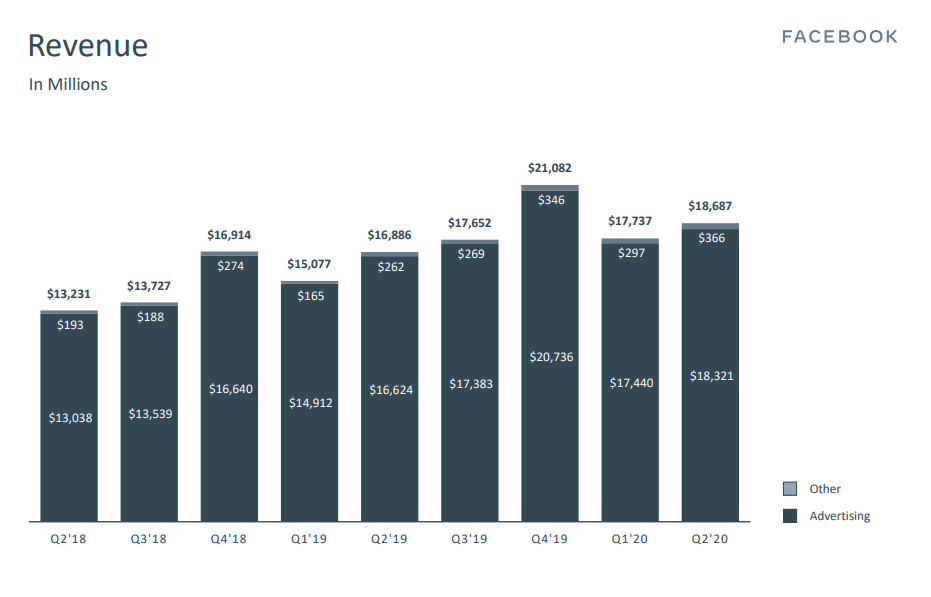

Majority of the stocks are high-growth (high revenue growth specifically) but they do not have a profit yet or have just become profitable recently.

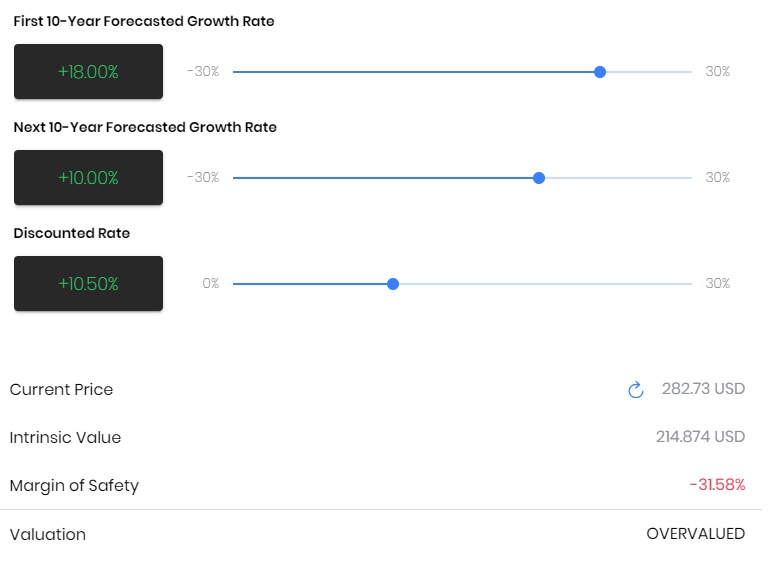

Performance of stocks in terms of share price appreciation over the long term is a result of revenue and eps (earnings per share) growth, so isn’t this good when these companies show 50% and even 100% revenue growth year on year? Well, in general yes but is the growth momentum sustainable and are you paying the right price for it?

Let’s take a look at a few selected stocks and the price performance:

Square

Unity

Block (or Square before they changed their name) dropped 50% from its all time high while Unity fell by 40% but has re-bounced somewhat these few days.

Block is a fintech darling, tremendous growth trajectory, already turning a profit with good FCF (free cash-flows) and its very popular Cash App has 70 million annual transacting active customers, catching up with PayPal’s Venmo.

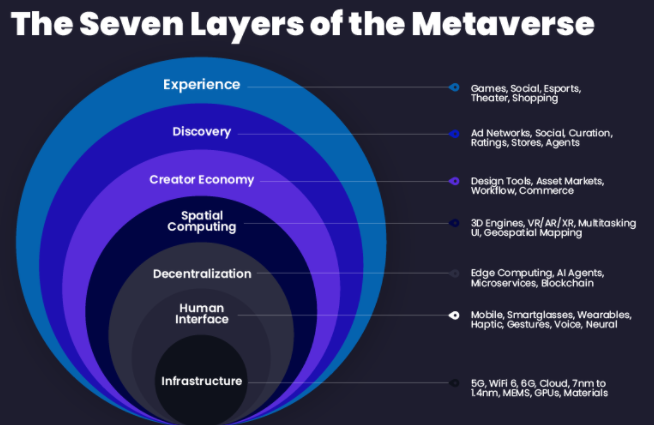

Unity as mentioned in the previous post on Metaverse, has many quarters of 40% plus YoY growth and we believe it to be able to dominate its space for many more years to go.

Why is it that both Block and Unity have corrected so much the recent months. A large part of the reasons is well reported, high inflation, Fed tapering and impending interest rate hikes. Lower liquidity and higher interest rate environment will cause a lower valuation premium especially for high-growth stocks with no profits yet.

However, we see that the reasons why some of these stocks were well liked remain intact, meaning the fundamentals and competitive advantages of these companies have not changed. No doubt, the over exuberance before has certain investors chase the prices to unbelievable highs and the huge corrections may just price these stocks fairly now.

Of the many stocks in ARKK, we particularly like the following stocks which we believe have tremendous economic moats and if you are a patient and long-term investor, you could well see the prices 2x or 3x over the next 3 to 5 years.

These are:

- Unity Software

- Block

- Palantir

- Roblox

However, have we found the bottom yet? Nobody can answer this question, and thus using the Dollar Cost Averaging strategy would probably be a good bet.

What do you think and which other stocks in ARKK do you like? Do leave your comments.

Disclaimer : contents presented here do not constitute any financial advice, and you should do your homework and make your own investment decision.

We are doing a soft launch of our program Master Value Investing in 4 Weeks, usual price is $598, and for a limited time only, we are giving a promotional discount of 50%, which means you will pick up a life-skill knowing how to invest in good quality multi-baggers, pay the right price and grow your capital. ONLY $299 now or less than $1 a day.

Register now.