Description

There are many books and courses on stock investment and I have myself read many books on investments and attended a few courses. The key steps to stock investment are straight-forward: (1) finding stocks to invest (2) research them (3) value them and (4) allocate funds to invest. My own experience is that there are many good books already written but my attempt here is to pull together the main contents necessary for you to have a solid foundation to start your investment journey. I have also intentionally kept the write-up brief and direct to the point knowing everyone is short of time or attention in a digital world.

The key principles of investing are simple but hard to execute, we only invest in wonderful companies which:

- You understand (or within your circle of competence)

- Have durable competitive advantages (or economic moat)

- Have good management

- Are sold at a discount (or margin of safety)

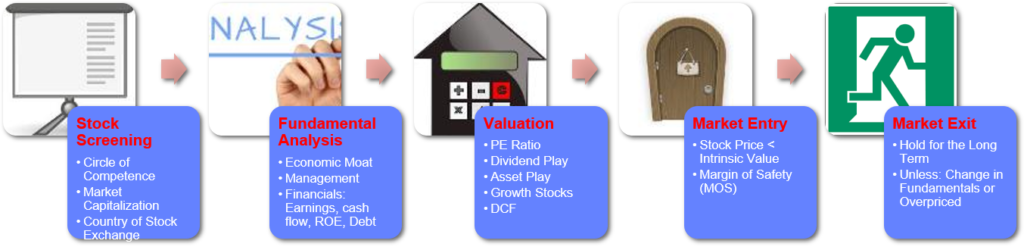

This book illustrates these key principles and then lays out the framework to help you do your homework, so that you can carry out research of companies you are interested to invest both qualitatively and quantitatively, going through the financial statements. This involves careful fundamental analysis using the PhD (Profitability, Financial Health and Growth Drivers) methodology and then the Valuation phase to buy wonderful companies at a discount.

The book details a step-by-step analysis using the following Stock Investment Framework and the tool-sets introduced equip you to begin deep-dive research of companies. The focus here is however on established companies which have some track records.

Accompanying this book is an app that we have developed which you can sign up for a trial account at https://app.calm-investing.com/login.

What our readers and students say:

Reviews

There are no reviews yet.