Description

Next Bootcamp

Date: 15th & 16th August 2020 (Saturday & Sunday) , 9 am to 5 pm

Cashflow Mastery Program (CMP) simplifies proven stock investment concepts, teaches you how to invest in wonderful companies with durable competitive advantages that ensure profitable growth of revenue, giving you great returns over the long term from stock price appreciation and dividend payments.

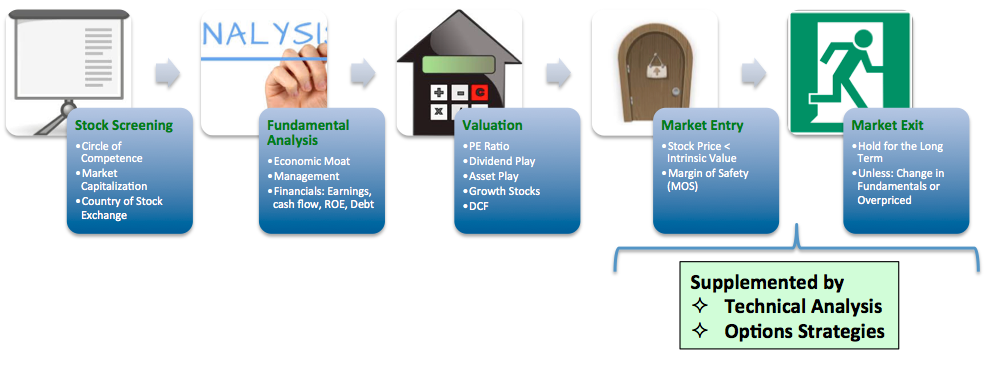

Simple technical analysis techniques are also taught for better market entry and exit. Options can dramatically improve investment returns and allow short-term opportunistic trades and this is covered in this course.

CMP follows the following stock investment framework.

First, we cover the concept of Circle of Competence, choosing the stocks that you should be more familiar with because of your work, your training & education and your interests. Then we cover the fundamental analysis through the PhD method (Profitability, Financial Health & Growth Drivers), identifying companies with lasting competitive advantages (or economic moat) and going through its financial performance in the forms of profitability (gross margin, net margin), revenue and earnings growth, cashflow generation, debt levels, ROE, ROA etc. This forms the basis of assessing whether a company meets the criteria of a “great company” that will grow profitably for a very long time to go.

The next step is to put a fair value to the company, how much you should be paying for it. Valuation is not rocket science but there are a number of valuation methodologies which will be covered for this purpose: PE ratio, PEG, Relative PE (historical trends and industry comparison) and Discounted Cashflow.

With that, you want to build in some margin of safety so you know you are absolutely buying a great company at a discount.

The course outline is as follows:

- Learn the 5-Step Stock Investment Framework

- Stock Screening

- Fundamental Analysis

- Valuation

- Market Entry

- Market Exit

- Managing Risk – Portfolio Sizing

- Introduction to Options

- Sell put to get cashflow (option premiums)

- Technical Analysis

This is $200 deposit payment towards Cashflow Mastery Program and or CMP + REITS TO RICHES BUNDLE to enjoy special rate of $1,997. Deposit payment is refundable only within 1 week of sign-up if the student decides to not enroll for the course later.

Reviews

There are no reviews yet.